nd sales tax rate lookup

Ad Be the First to Know when North Dakota Tax Developments Impact Your Business or Clients. Sales tax rates in North Dakota are destination-based meaning the.

Car Tax By State Usa Manual Car Sales Tax Calculator

Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance.

. Apply more accurate rates to sales tax returns. With local taxes the total sales tax rate is between 5000 and 8500. Depending on local municipalities the total tax rate can be as high as 85.

Find Sales tax rates for any location within the state of Washington. Ad Compare Your 2022 Tax Bracket vs. Exemptions to the North Dakota sales tax will vary.

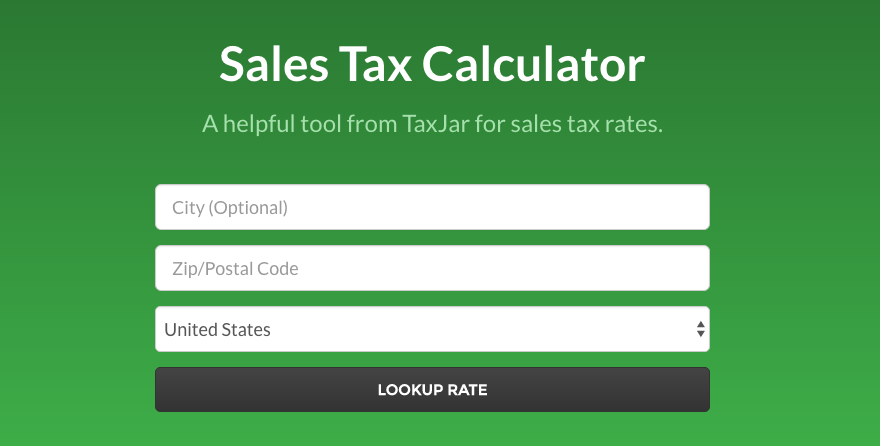

Find sales tax rates in North Dakota by address or ZIP code with the free North Dakota sales tax calculator from SalesTaxHandbook. Lookup other tax rates. Ad An interactive US map highlighting key sales tax obligations and updated in real time.

Depending on local municipalities the total tax rate can be as high as 85. To calculate sales and use tax only. Your 2021 Tax Bracket To See Whats Been Adjusted.

North Dakota has recent rate changes Thu Jul 01. The North Dakota ND state sales tax rate is currently 5 ranking 33th-highest in the US. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. North Dakota assesses local tax at the city and county. Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck.

Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance. Local Taxing Jurisdiction Boundary Changes 2021. Find the TCA tax code area for a specified location.

Avalara calculates collects files remits sales tax returns for your business. Sellers use our guide to keep current on all nexus laws and the collection of sales tax. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax.

Here youll find information about taxes in North Dakota be able to learn more about your individual or business tax obligations and explore history and data related to taxes. Local Sales Tax Rate Lookup The Sales and Use Tax Rate Locator only includes state and local sales and use tax rates and boundaries for North Dakota. Ad Be the First to Know when North Dakota Tax Developments Impact Your Business or Clients.

The base state sales tax rate in North Dakota is 5. The North Dakota ND state sales tax rate is currently 5. Exemptions to the North Dakota sales tax will vary.

Bloomberg Tax Expert Analysis Your Comprehensive North Dakota Tax Information Resource. Avalara calculates collects files remits sales tax returns for your business. The North Dakota sales tax rate is 5.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. Guidelines are listed below by tax type. City of Bismarck North Dakota.

See it in Action. These tools provide the option for users to search and filter by. Ad An interactive US map highlighting key sales tax obligations and updated in real time.

The state sales tax rate in North Dakota is 5000. Quickly learn licenses that your business needs and. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

See it in Action. Bloomberg Tax Expert Analysis Your Comprehensive North Dakota Tax Information Resource. Sellers use our guide to keep current on all nexus laws and the collection of sales tax.

Get information about sales tax and how it impacts your existing business processes. The 4 is optional. Here is how much you would pay inclusive of sales tax.

Each county city and special district can add sales taxes on top of the state rate. To search for a specific guideline use the search boxes to enter the name of the guideline select the tax type or include the guidelines. Use this search tool to look up sales tax rates for any location in Washington.

North Dakota has 126 cities counties and special districts that collect a local sales tax in addition to the North Dakota state sales taxClick any locality for a full breakdown of local property. In addition to the above reports Lookup Tools are available from the Office of State Tax Commissioner. It does not include special taxes such.

See Whats Been Adjusted For Income Tax Brackets In 2022 vs.

State Sales Tax Rates And Combined Average City And County Rates Download Table

Sales Use Tax South Dakota Department Of Revenue

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Transaction Privilege Tax Queen Creek Az

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Tax Collector Millburn Township Nj Official Website

Las Vegas Sales Tax Rate And Calculator 2021 Wise

State And Local Sales Tax Rates 2019 Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

What Is Nexus For Ecommerce Stores The Digital Merchant

Welcome To The North Dakota Office Of State Tax Commissioner

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Mesa County Colorado