taxing unrealized gains crypto

OUR STOCK TRADING GAME. Bitcoin sank to a weekly low on Monday after spending four of the last five days in a reversal that wiped off a strong start to last week.

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

Shareholders equity at December 31 2021 included a net unrealized gain on investment securities and derivatives of 96 billion compared with a net unrealized gain of 103 billion at December.

. It was an up and down week for the overall crypto market which closed the period down 066. The Plan gives the Fund greater flexibility to realize long-term capital gains and to distribute those gains on a regular monthly basis. 2 Based on managed assets and investment managers sector.

This is a BETA experience. The Stock Market Simulation Version 30 is a spin-off from Wall Street Raider a simulation in which you are not a billionaire tycoon who can influence or manipulate stock prices but just a small middle-class investor with a 100000 inheritance to invest or speculate with. The Funds monthly distributions to its shareholders may be comprised of ordinary income net realized capital gains and return of capital in order to maintain a level distribution.

I would say it is illegal in every state but I have not checked the law in every state. It is not a substitute for specific advice in your own circumstances. As such we think you will find it a lot more challenging than Wall.

Today he is worth 265 billion on paper. He is not a fan of the proposed billionaire tax which would tax unrealized gains in the value of. Most states tax capital gains as income.

Yes you need to report crypto losses on IRS Form 8949. Each state has its own method of taxing capital gains. The crypto reversal continues Crypto gets off to a rough start for the week as Bitcoin waves goodbye to the 38k mark.

In states that do this the state income tax applies to both long-. On December 23 2021 the Fund announced monthly distributions of 0087 per share in accordance with the Plan.

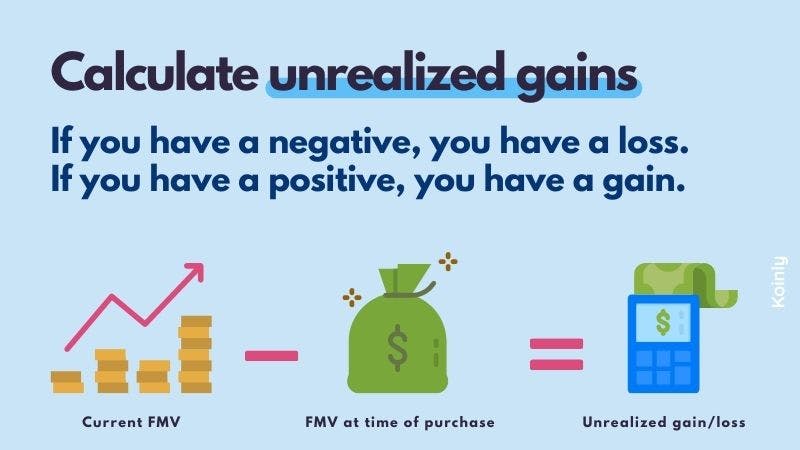

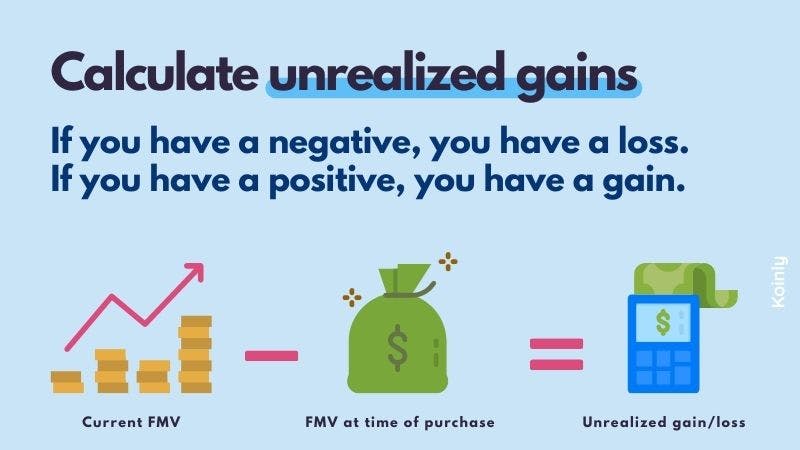

Crypto Tax Unrealized Gains Explained Koinly

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

![]()

Bitcoin Tax Vs Cointracking Vs Cryptotrader Tax Cryptowisser Blog

Crypto Tax Unrealized Gains Explained Koinly

Best Crypto Price Tracker Coin Values Best Crypto Track Investments

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles Charts And Guides

Three Tax Free Crypto Transfers

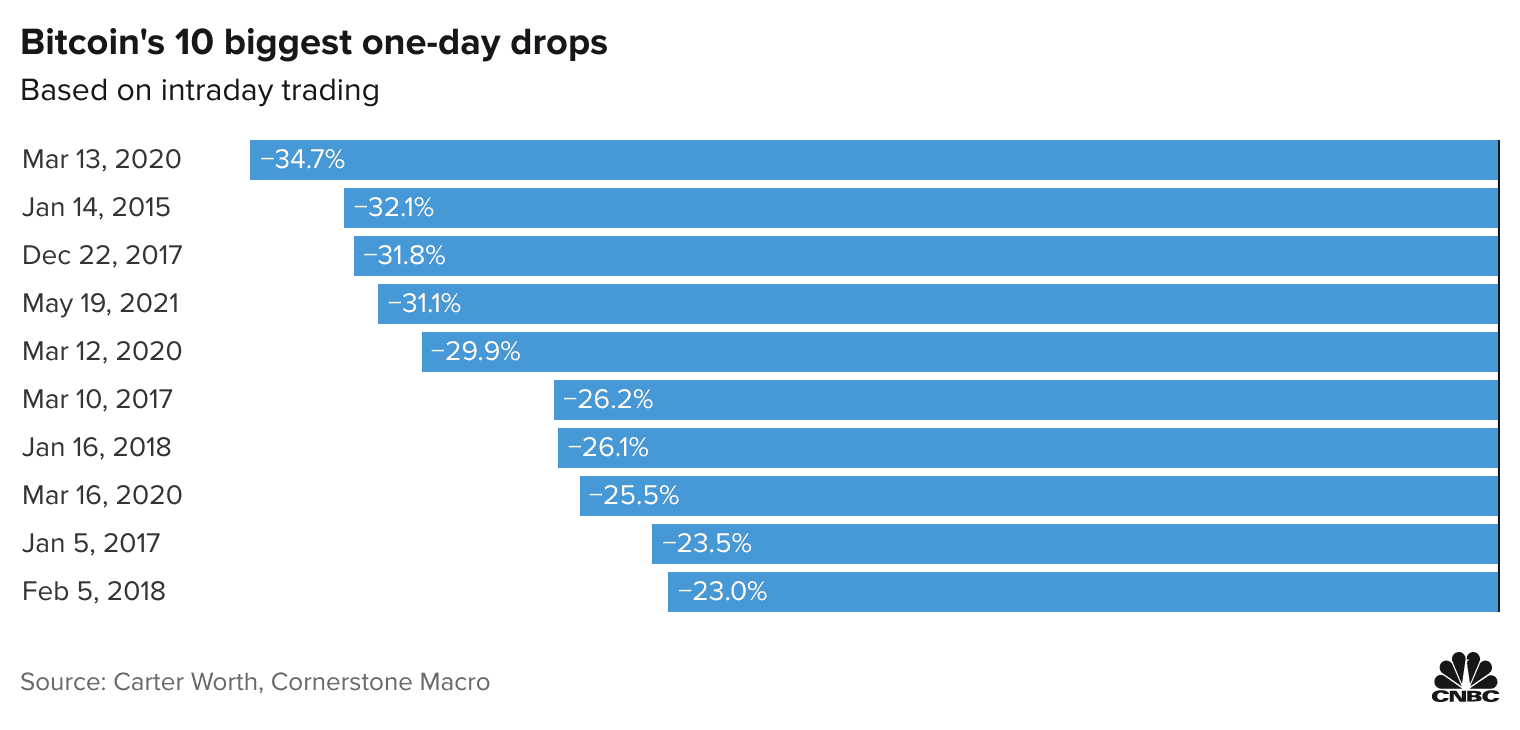

Bitcoin Crash Opens Door To A Tax Loophole For Investors

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Confusing U S Tax Laws Lead To 5 Billion In Unrealized Crypto Losses

Crypto Tax Unrealized Gains Explained Koinly

Crypto Taxes In 2021 What Should You Know By Changenow Io Medium

8 Ways To Avoid Crypto Taxes In Canada 2022 Koinly

Crypto Tax Unrealized Gains Explained Koinly

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Guide To Canadian Cryptocurrency Taxation National Crowdfunding Fintech Association Of Canada

Behind Bitcoin A Closer Look At The Tax Implications Of Cryptocurrency Poole Thought Leadership